(Kitco News) – Gold has decoupled from the interest rate outlook and real yields, and even though prices have already risen sharply, the structural bull case for gold remains intact, according to commodity strategists at J.P. Morgan.

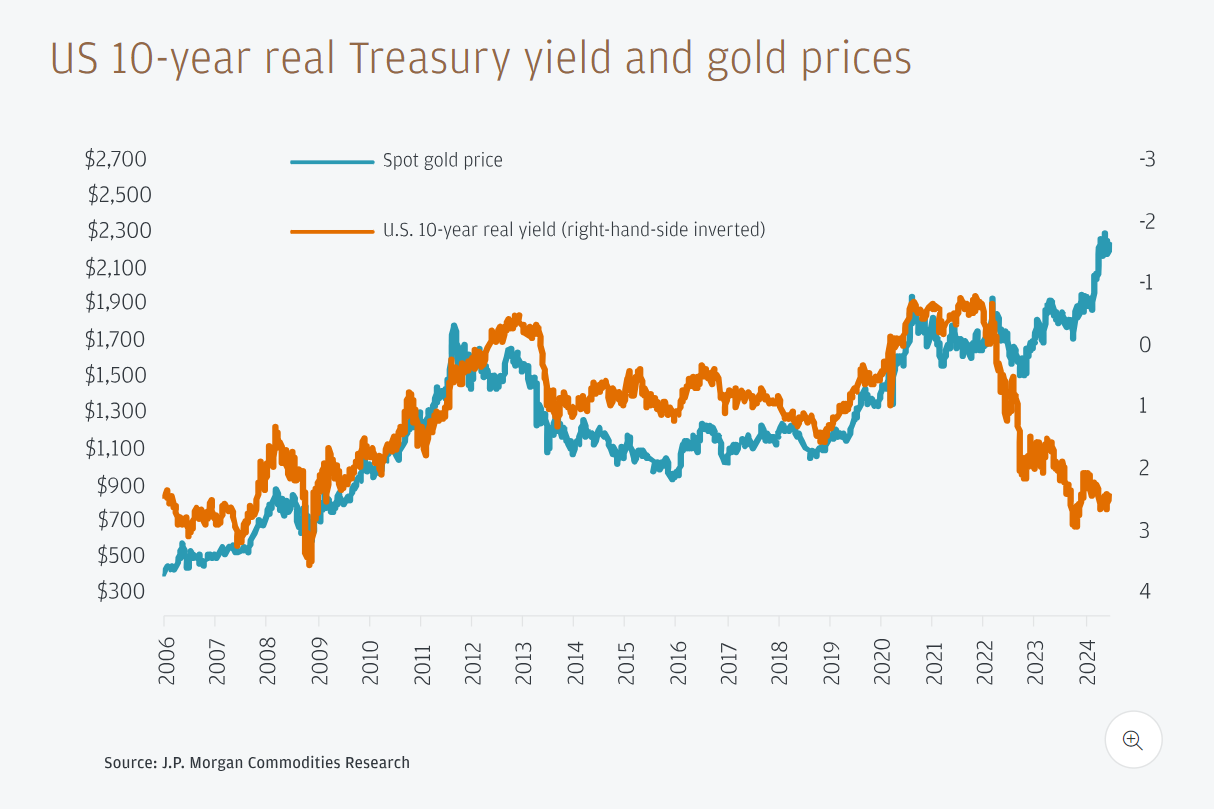

The strategists noted in a report published on July 15 that a weaker U.S. dollar and lower U.S. interest rates traditionally boost the appeal of non-yielding bullion, but since early 2022 gold’s relationship with real yields has been breaking down.

“Gold’s resurgence has come earlier than expected, as it further decouples from real yields,” said Gregory Shearer, Head of Base and Precious Metals Strategy at J.P. Morgan. “We have been structurally bullish gold since the fourth quarter of 2022 and with gold prices surging past $2,400 in April, the rally has come earlier and has been much sharper than expected. It has been especially surprising given that it has coincided with Fed rate cuts being priced out and U.S. real yields moving higher due to stronger labor and inflation data in the U.S.”

“Amid fraying geopolitics, increased sanctioning and de-dollarization, we observe an increased appetite to buy real assets including gold,” Shearer said. Recent data also shows reluctance among physical holders to sell their gold despite the strong price gains, underscoring the structurally bullish drivers irrespective of U.S. real yields.

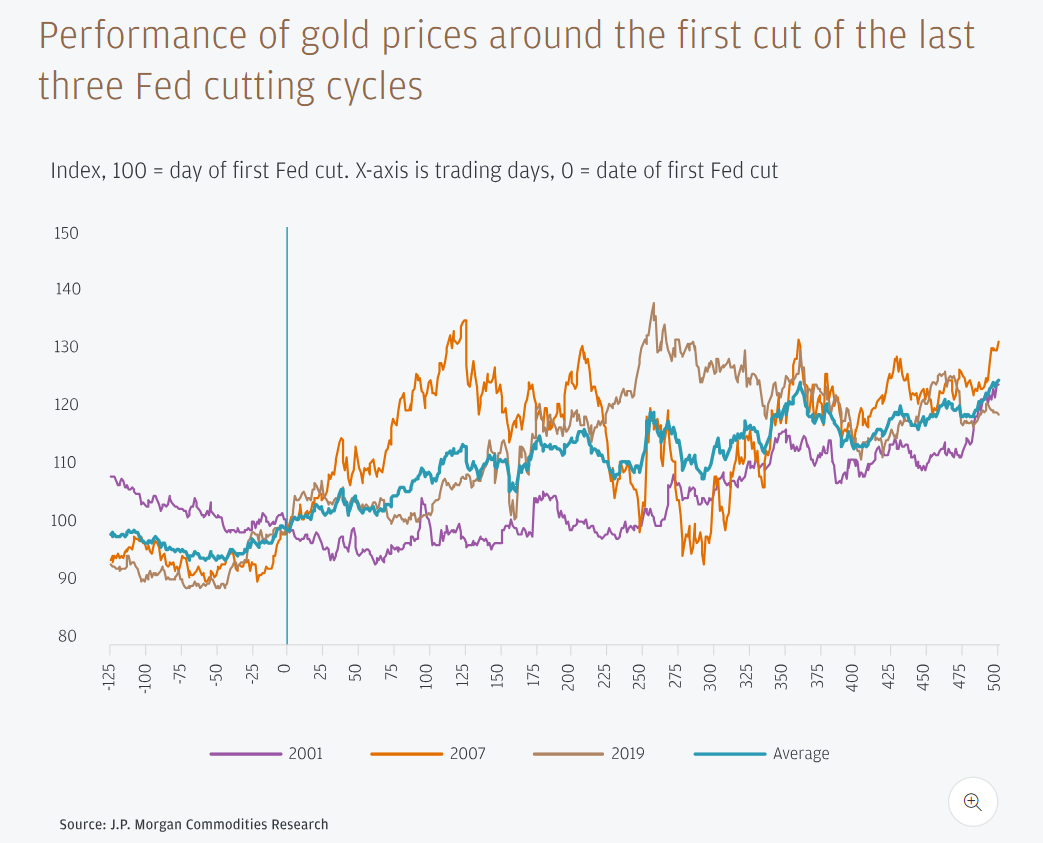

With gold prices already hovering near all-time highs, J.P. Morgan sees further potential for the yellow metal as U.S. rates begin to fall.

“Many of the structural bullish drivers of a real asset like gold — including U.S. fiscal deficit concerns, central bank reserve diversification into gold, inflationary hedging and a fraying geopolitical landscape —have lifted prices to new all-time highs this year despite a stronger U.S. dollar and higher U.S. yields, [and] will likely remain in place regardless of the U.S. election outcome this autumn,” said Natasha Kaneva, Head of Global Commodities Strategy at J.P. Morgan. “Nonetheless, precious metals markets will be focused on any potential policy changes that could accentuate or alter one or more of these themes.”

Shearer reiterated the firm’s strong positive position on the medium-term outlook for gold as well as silver prices. “Across all metals, we have the highest conviction on a bullish medium-term forecast for both gold and silver over the course of 2024 and into the first half of 2025, though timing an entry will continue to be critical,” he said.

The report said that any retracement in the coming months will provide investors with “an opportunity to begin positioning for further strengthening” ahead of the Fed’s expected rate cuts.

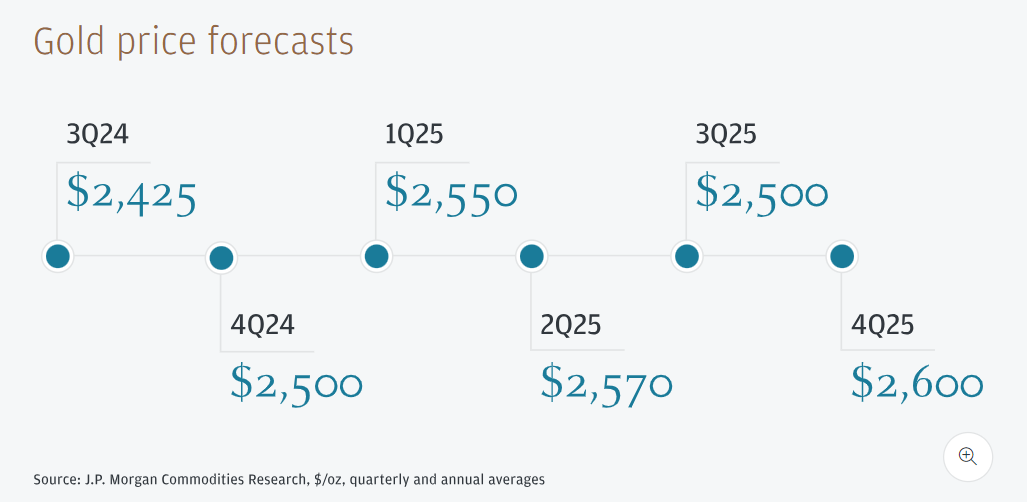

The firm has also upgraded its gold price targets for both 2024 and 2025. According to the latest J.P. Morgan Research estimates, gold prices are now expected to reach $2,500 per ounce by the end of 2024. The new estimates assume the Fed rate-cutting cycle will begin only in November, while markets are fully priced in for a September cut.

“The direction of travel is still higher over the coming quarters, forecasting an average price of $2,500/oz in the fourth quarter of 2024 and $2,600/oz in 2025, with risk still skewed toward an earlier overshoot,” Shearer said.

The new price predictions are based on J.P. Morgan’s updated economic forecasts, which see U.S. core inflation moderating to 3.5% in 2024 and 2.6% in 2025.

| TIME | |||||

|---|---|---|---|---|---|

| Sydney | Tokyo | Ha Noi | HongKong | LonDon | NewYork |

| Prices By NTGOLD | ||

|---|---|---|

| We Sell | We Buy | |

| 37.5g ABC Luong Bar | ||

| 9,553.30 | 8,568.30 | |

| 1oz ABC Bullion Cast Bar | ||

| 7,971.00 | 7,106.00 | |

| 100g ABC Bullion Bar | ||

| 25,391.90 | 22,521.90 | |

| 1kg ABC Bullion Silver | ||

| 4,954.90 | 3,564.90 | |

Powered by: Ngoc Thanh NTGold

- Online: 64

- Today: 2351

- Total: 7158215