(Kitco News) – Gold traders went on a now-familiar journey this week, as the yellow metal was pushed up during the Asian trading session, only for European and American investors to arrive and either confirm the trend or drive prices sharply lower.

Spot gold kicked off the week trading precisely at the $2,400 per ounce level, which has functioned as strong support and resistance throughout the summer. The yellow metal saw its first sharp correction of the week just before 7:00 am EDT on Monday, falling from $2,407 per ounce to $2,386 by 11:30 am. By Monday evening, Asian traders had pushed the spot price back above $2,400, but their momentum flagged and gold fell once again to the $2,380s by the early morning.

From there, spot gold began its strongest and steadiest climb of the week, rising from $2388.47 at 2:15 am EDT. to the weekly high of $2,430.37 shortly before 11:00 am Wednesday. This elevated level proved unsustainable, however, and spot gold sold off sharply during the remainder of the North American trading session, and fell further still during the overnight, ultimately hitting the weekly low of $2,354.60 per ounce by 1:30 pm EDT on Thursday.

At this level, the yellow metal was once again attractive, and bulls arrived in force to push the price action into the mid-$2,360s by the end of the North American trading session, after which in continued all the way to a double top at $2,376 per ounce around midnight before seeing a slight pullback.

Friday’s North American session brought a mixture of renewed optimism about rate cuts and rollovers on the forward futures contract, propelling gold steadily higher to twice test resistance at $2,390 by early afternoon before pulling back to the mid-$2,380s.

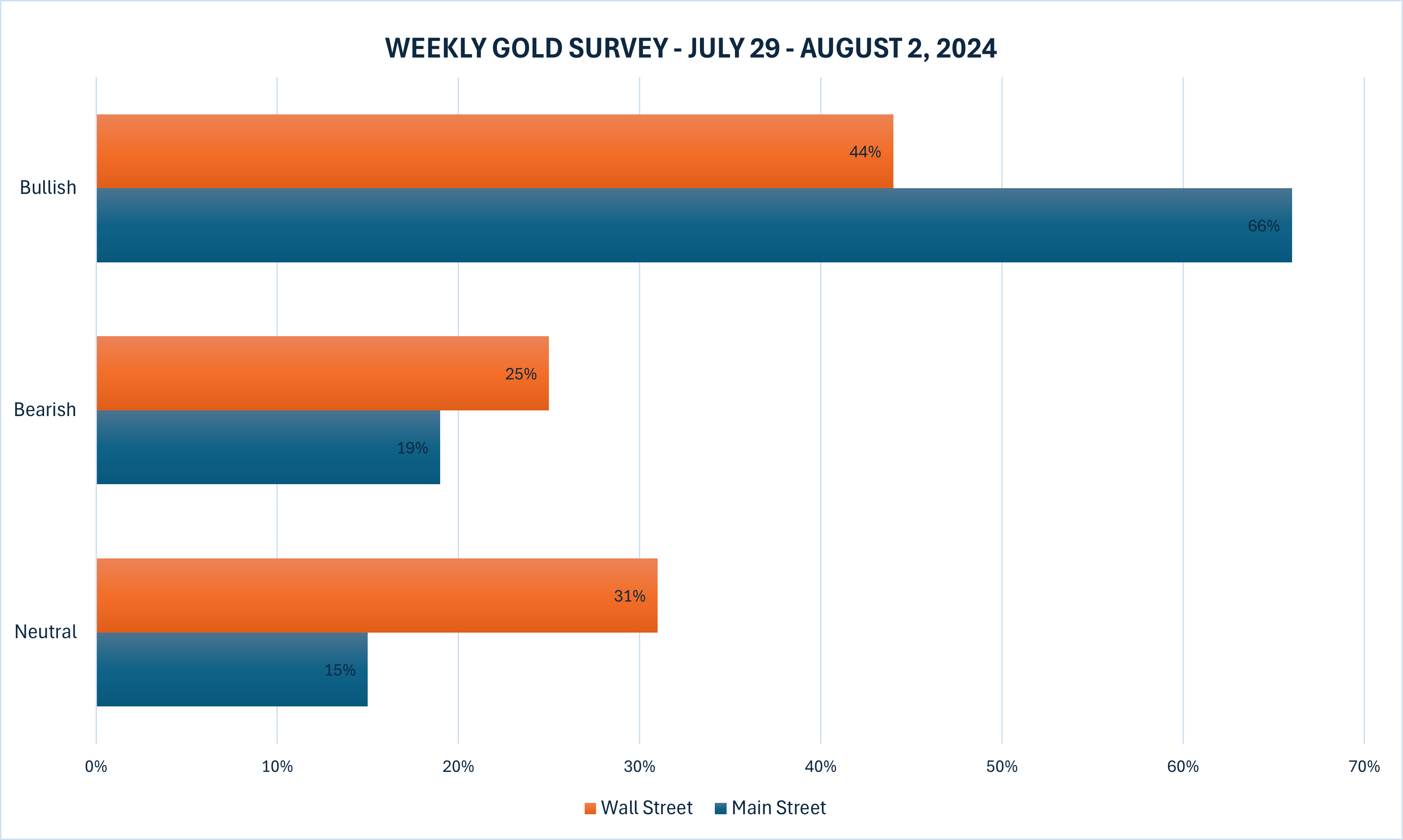

The latest Kitco News Weekly Gold Survey shows industry experts leaning more bullish once again, while retail sentiment further improved from last week.

“I am bullish on Gold for the coming week,” said Colin Cieszynski, Chief Market Strategist at SIA Wealth Management. “My thinking is that If Powell comes out dovish at the Fed meeting and hints toward a Sept interest rate cut, that could push the USD down and help Gold to rebound.”

“I even look at Core PCE inflation today, which was neutral to slightly hawkish and yet USD is down, treasury yields are down, and gold is up,” Cieszynski added.

“Down,” said Darin Newsom, Senior Market Analyst at Barchart.com. “Based on the idea Dec gold closes lower for the week this Friday, another round of selling next week could lead to a third consecutive lower weekly close. Support on the contract’s weekly chart is at a series of lows near $2,350. Weekly stochastics remain neutral, well above the oversold level of 20%, meaning there is still time and space for the contract to move lower.”

“I suspect consolidation is the most likely scenario,” said Marc Chandler, Managing Director at Bannockburn Global Forex. “Gold in the cash market approached my target (~$2350) and found support to recover to almost $2380 at the end of the week. The momentum indicators are still falling, and the five-day moving average is crossing below the 20-day average for the first time since very early in the month. The $2400 area offers resistance.”

“Up,” said Adrian Day, President of Adrian Day Asset Management. “Gold will rise as the chances of a near-term rate cut by the Federal Reserve increase.”

“Still cautious,” said Mark Leibovit, publisher of the VR Metals/Resource Letter. “Risk to 1900-2000.”

Kevin Grady, President of Phoenix Futures and Options, said much of the price action this week was driven by weak earnings reports and rollovers between the futures contracts.

“I think if you look at the days that gold sold off, I think they correlated with the big drops in the S&P,” he said. “There's two things that are happening here. One, gold right now, is in a big rollover. The Aug contract is rolling over to Dec. That's a major deal. It's a major deal for the funds, it's a major deal for the banks, it's a major deal for everybody.”

“When you look at a roll, there's an ebb and flow,” he added. “The index rolls are always passive; they're always long, and they always stay long, so that position doesn't change. But a lot of the shorter-term funds wait until the end, because they just say, ‘Hey, you know what? If the price is coming off, I don't want to get out of my position and pay to roll it into December and then have to liquidate if something happens like a selloff.’ Which is basically what happened.”

“A lot of those positions hold until the very end, so I think you also had margin selling coming because of those big S&P selloffs,” Grady said. “You saw big drawdowns in those S&P positions, and I think people had some profitable positions in gold, and they said, ‘you know what? Let me liquidate some of these and raise some of that capital.’”

“I think as equities are rallying back now here today, you're starting to see some people buying some back.”

“If you just look at the big picture of where gold actually is, you need to sell off like that,” Grady added. “It's healthy. Even the S&P selloff is healthy. You can't have everything just keep going straight up. And I think it shakes out a lot of the short-term trend followers.”

Grady said that in the near term, he expects gold to continue to take its lead from equities, which means the price action is skewed to the upside. “I think it's going to stay stable to higher, because equities will stay stable to higher,” he said. “There's a lot of noise [in the markets], but primarily, I think gold's going to stay steady.”

He also expects the Fed to remain supportive of the yellow metal. “I think the [PCE] number today is going to help,” he said. “The assumption would be that today's number is going to help with some verbiage [from Powell] towards those rate cuts. That would be consistent with what's going on.”

This week, 16 analysts participated in the Kitco News Gold Survey, with Wall Street showing renewed optimism about the near-term prospects for the precious metal. Seven experts, representing 44%, expect to see gold prices rise next week, while only four, or 25%, now predict a price decline. The remaining five analysts, or 31%, see gold trending sideways during the week ahead.

Meanwhile, 193 votes were cast in Kitco’s online poll, with Main Street investors getting more bullish compared to last week. 127 retail traders, or 66%, looked for gold prices to rise next week. Another 37, or 19%, expected the yellow metal to trade lower, while 29 respondents, representing the remaining 15%, saw prices consolidating within a range next week.

Next week's trading risk will focus on the last two days, with the Federal Reserve’s July interest rate decision and press conference on Thursday afternoon, followed by the release of the U.S. nonfarm payrolls report for July on Friday morning. While the overwhelming majority of market participants expect a hold from the central bank, precious metals traders will be very interested to hear if Fed Chair Jerome Powell's tone shifts in response to this week’s higher-than-expected July PCE inflation report.

Other notable events include Jolts job openings for June and the Conference Board's consumer confidence survey for July on Tuesday, the Bank of Japan interest rate decision and ADP employment on Wednesday, and the Bank of England’s rate announcement, weekly jobless claims and ISM manufacturing PMI on Thursday.

Markets will also receive new data on the beleaguered U.S. housing sector next week, with the release of the S&P-Case Shiller