(Kitco News) – Gold enjoyed one of its strongest runs of the year this week, as downbeat U.S. data and a more dovish Fed combined to boost the yellow metal, and even Friday's flash crash did little to dampen precious metals traders' enthusiasm.

Spot gold kicked off the week trading only a couple of dollars below the $2,400 per ounce level, and the yellow metal’s price held steady between $2,375 and $2,400 before breaking definitively through resistance at 1:00 pm EDT on Tuesday as weaker-than-expected U.S. manufacturing data cemented traders’ certainty that the Fed would lean dovish on the last day of the month.

Gold traders kicked off Wednesday’s North American session by pushing spot gold to a fresh weekly high close to $2,430 per ounce, before pulling back to await the Fed’s rate announcement and Chair Powell’s press conference.

The yellow metal liked what it heard, with spot gold rocketing from $2,422.43 just before the 2:00 pm release of the monetary policy statement to a fresh weekly high of $2,457.86 shortly after 9:00 pm EDT. Gold then traded in its newly established elevated range between $2,430 and $2,460 as weekly jobless claims reinforced the view of a weakening U.S. economy.

Friday morning, however, brought the ultimate confirmation, with U.S. nonfarm payrolls for July coming in well below expectations, and the unemployment rate ticking up two-tenths to 4.3%. This drove spot gold to a double top above $2,470 per ounce, after which precious metals followed the broader market sharply lower as traders abandoned risk assets across the board. Spot gold saw one of its sharpest selloffs of the year, falling from $2,471.96 per ounce at 10:00 am EDT all the way to $2,413.69 just one hour later.

But gold prices bounced along with equities, and spot gold returned to trade above $2,430 per ounce for the remainder of the North American session.

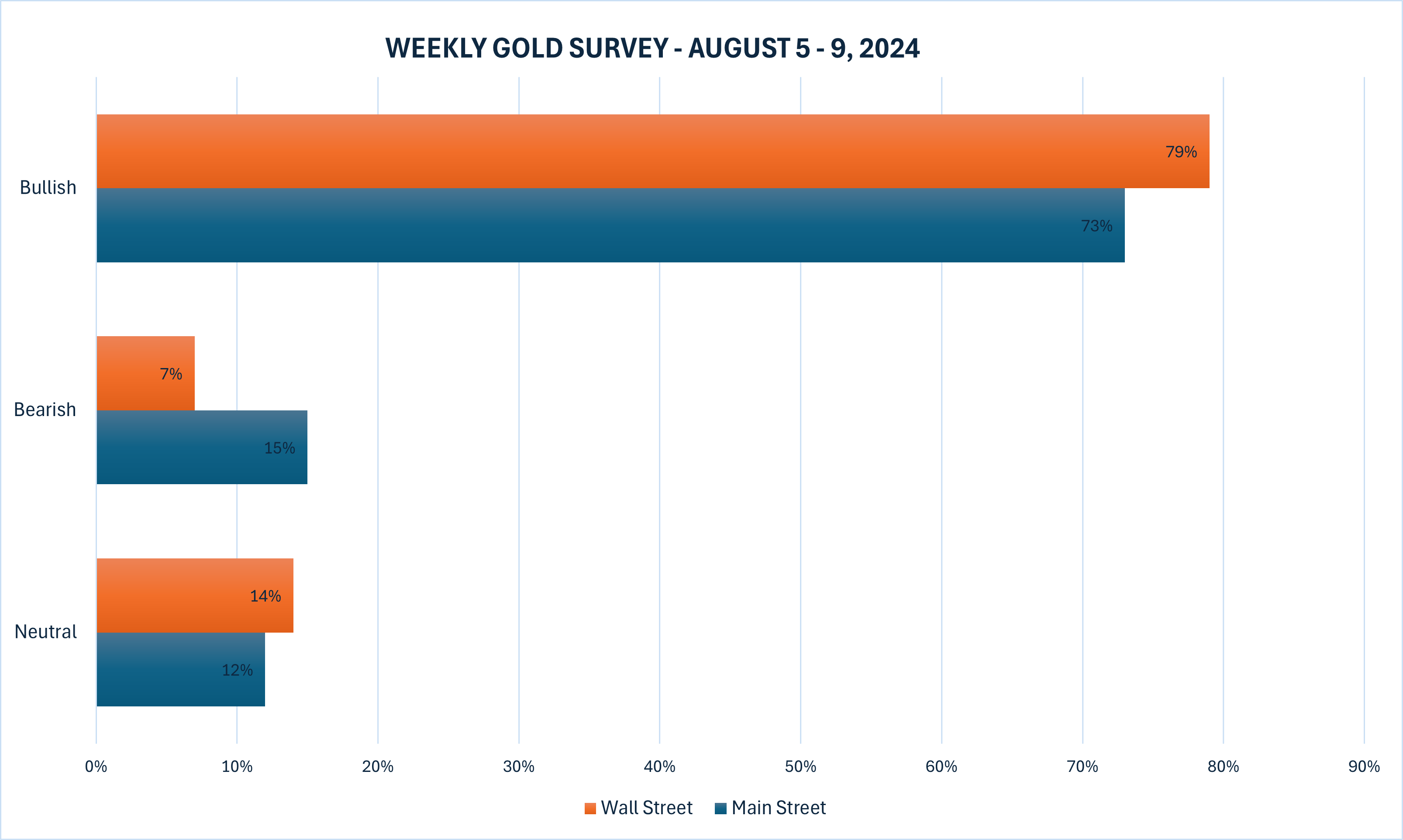

The latest Kitco News Weekly Gold Survey shows retail investors overwhelmingly expect the yellow metal to make further gains next week, while industry experts are even more convinced of gold’s upward trajectory.

Adrian Day, President of Adrian Day Asset Management, expects gold prices to push higher next week.

“Gold has a real shot at breaking above its previous high as the U.S. economy weakens and the odds of a rate cut increase,” Day said. “At his press conference earlier in the week, Fed Chairman Jerome Powell was almost champing at the bit to cut rates but waiting for the opportunity to do so. He now has that opportunity. In the last several rate-cutting cycles, when the Fed starts to cut rates, gold moves up.”

Marc Chandler, Managing Director at Bannockburn Global Forex, sees the price action settling down next week. “The sharp drop in US rates and a weaker dollar helped push gold higher,” he said. “In the spot market gold had its best week in nearly four months, rising by about 3.6%, with about a third of the gains coming at the end of the week.”

Chandler noted that the U.S. 2-year yield fell more than 40 basis points last week, the biggest weekly decline of 2024. “Gold looks set to challenge last month’s record high (~$2483.75, spot),” he said. “The upper Bollinger Band is slightly above $2480. It is difficult to talk about resistance in uncharted waters, but $2500 is the next psychological target. Expect a quieter week ahead.”

“I’m taking a different tack this week,” said Darin Newsom, Senior Market Analyst at Barchart.com. “Technically, it is a coin toss with no clear trend signals. The daily chart for Dec gold shows the contract has rallied off the low end of its recent range, meaning it could test the high end near $2,540.”

Michele Schneider, Chief Strategist at MarketGauge.com, is bullish on the yellow metal for next week. “Gold needs to hold $2450,” she said.

Bob Haberkorn, Senior Commodities Broker at RJO Futures, said Friday’s dramatic selloff was driven by fears of a recession following the weak U. S. job report. “I think if anything, there's an opportunity right here to buy gold,” he said as the yellow metal’s spot price traded near $2,420 per ounce. “I think they're throwing the baby out with the bath water.”

Haberkorn said he didn’t see gold’s sharp drop as evidence that traders were taking short positions. “I think it's profit-taking, stops getting triggered,” he said. “As well, there could be people having some margin issues across the board in equity-type accounts, so they're liquidating everything. I think that's what this whole move is all about.”

“If you look at the headlines and what's going on in the world at this moment, gold is a safe haven asset,” he added. “It should be trading higher.”

Haberkorn said he expects gold to trade higher into the weekend, and to pick up wherever it leaves off on Monday. “In the next week, I would not want to be selling gold,” he said. “People are looking to get out of stuff heading into the weekend. There is a lot of risk this weekend with Iran and Israel. This selloff looks way overdone to me.”

“I think we'll see gold higher in the next week, just because I think it'll flip after today's selloff,” he added. “I think the reality sets in, you get the flight to safety in this market here. The fear of recession and weak jobs number alone should be pushing gold higher, and it continues higher next week to take out that $2,500 level again.”

This week, 14 analysts participated in the Kitco News Gold Survey, with Wall Street optimism on gold surging after equities were staggered amid economic and geopolitical threats. Eleven experts, fully 79% of the total, expect to see gold prices post further gains next week, while only one, or 7%, predicts a price decline. The remaining two analysts, or 14%, see gold trending sideways during the week ahead.

Meanwhile, 191 votes were cast in Kitco’s online poll, with the bullishness of Main Street investors coming in just behind the experts. 140 retail traders, or 73%, looked for gold prices to rise next week. Another 28, or 15%, expected the yellow metal to trade lower, while 23 respondents, representing 12%, saw prices in a consolidation pattern next week.

After digesting a multiplicity of significant economic news events this week, markets will get a well-earned breather during the week to come. The highlights, such as they are, will be the ISM Services PMI for July on Monday, and the Reserve Bank of Australia's monetary policy decision on Tuesday.

Markets will also keep a close eye on the U.S. 10-year bond auction on Wednesday and the 30-year auction on Thursday after the dramatic rally in Treasuries seen at the end of the week.

Christopher Vecchio, head of futures strategies and forex at Tastylive.com, is neutral on gold next week, but he is bullish into the year-end. “Dips should be bought,” he said.

James Stanley, senior market strategist at Forex.com, sees no reason to doubt the precious metal. “Bulls are still in control,” he said. “Once $2500 trades in spot, that could change, but in my view, buyers still have the handle.”

Adam Button, head of currency strategy at Forexlive.com, said he’s looking through the equity selloff and watching Treasuries as a true barometer for market sentiment. “The bond market is sniffing out some big trouble and it has been all week,” he said. “The job report's not that bad.”

Related news