(Kitco News) – After one of the strongest and steadiest price climbs of the year this past week on its way to fresh record-setting highs, and with domestic and international tensions supporting uncertainty, it's no surprise that market participants see nothing but blue skies ahead for gold.

Spot gold kicked off the week trading in the low $2,650s, spiking as high as $2,665 per ounce in the early morning and starting the North American trading session at $2,659 per ounce on Monday. After a relatively uneventful day, the last the yellow metal would see this week, it slid to the weekly low below $2,640 per ounce just after 1:00 a.m. on Tuesday before recovering to trade at $2,651 by the North American open.

After that, the yellow metal began its relentless march higher, setting a fresh weekly high of $2,668 per ounce at noon on Tuesday before breaking through the $2,670 level just before 2 a.m., and setting a fresh high of $2,684 at the North American open on Wednesday.

Spot gold then spent most of Wednesday trading in a narrow range between $2,674 and $2,684 before rising to $2,687 ahead of the Thursday open. By 10:45 a.m. it was hovering just $3 below $2,700 per ounce, and shortly after 9:00 p.m. eastern, it broke definitively through that level, topping out just below $2,713 per ounce at 1:30 a.m. EDT overnight.

The show was not over, however. Following a brief retracement to retest the $2,700 level, it was off to the races once again, with spot gold setting a succession of session and all-time highs of $2,714 per ounce by 8:15 a.m. $2,719 by 10:30 a.m., and the current all-time high of $2,722.13 just after 4:15 p.m. Eastern.

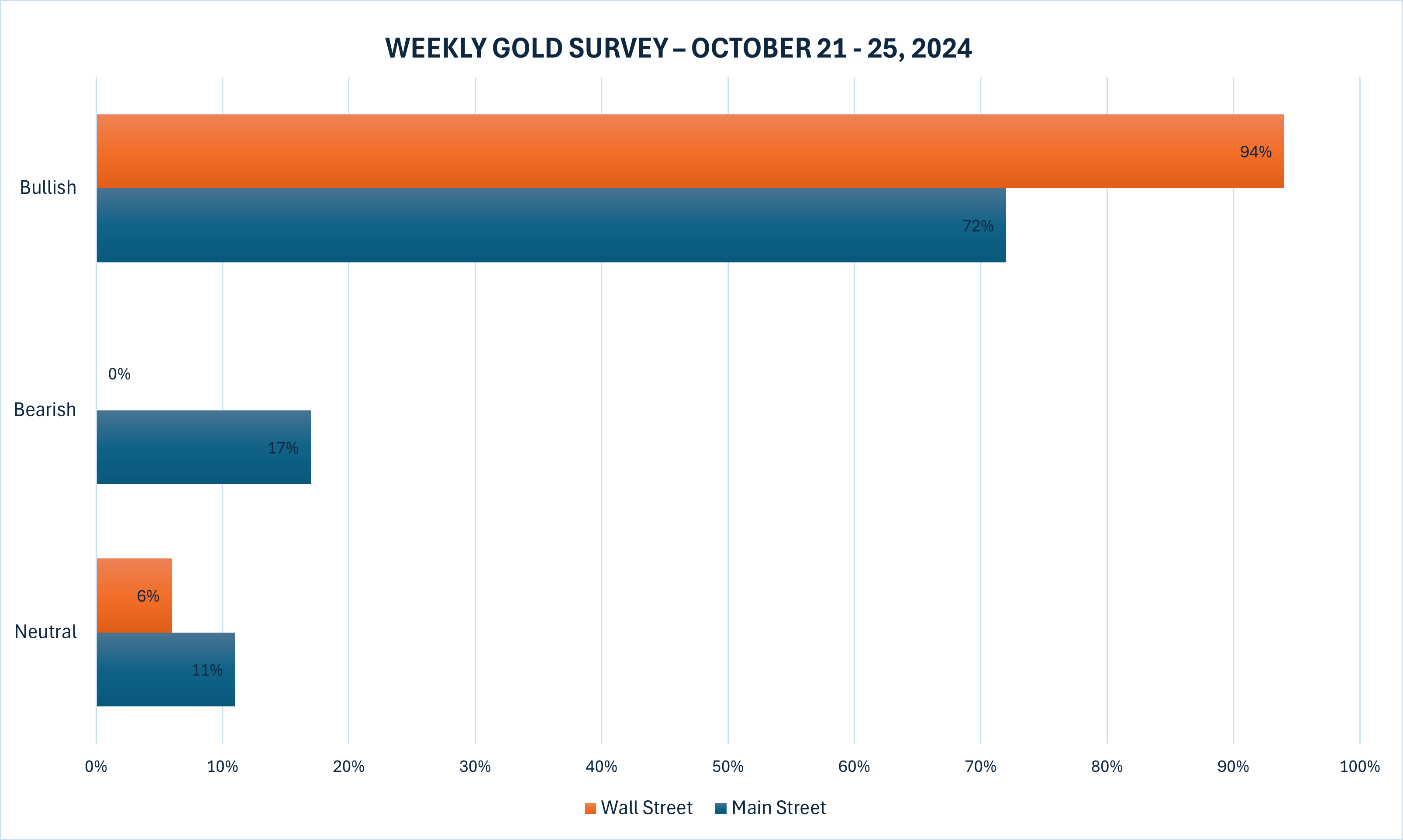

The latest Kitco News Weekly Gold Survey showed industry experts nearly unanimous in their bullish outlook for gold, while a strong majority of retail sentiment also moved back into optimistic territory after three straight weeks of diminishing belief in the yellow metal’s momentum.

“I am bullish on Gold for the coming week,” said Colin Cieszynski, chief market strategist at SIA Wealth Management. “The current rally appears unrelenting and with the price breaking out to new highs and nothing notable on the calendar, Gold’s positive momentum. What remains most important for Gold is that this rally is being driven by a general appreciation against all currencies and not just the USD. In the case of this week, a surge was sparked by the ECB rate cut.”

Marc Chandler, managing director at Bannockburn Global Forex, said that on balance, gold still has upward momentum.

“Gold reached new highs before the weekend near $2717. The last leg up has taken place alongside a stronger US dollar and higher US rates,” he said. “Middle East tensions remain elevated and the upcoming BRICS summit highlights the central bank demand for the yellow metal.”

“While the momentum indicators are constructive, spot gold is above its upper Bollinger Band,” he added. “Meanwhile, the US election is coming into focus, and although it still appears to be a close contest, the implications of possible Trump victory are significant and likely supportive for gold.”

“Up,” said Darin Newsom, senior market analyst at Barchart.com. “Global investors should continue to hedge against uncertainty and potential chaos ahead of the next US presidential election. Again, there are global players growing more desperate to create political change.”

“Higher, said Adam Button, head of currency strategy at Forexlive.com. “The momentum is impressive. There’s no need to fight it.”

“Up,” agreed James Stanley, senior market strategist at Forex.com. “There’s little reason to question the trend now especially after a continually impressive showing from bulls to press forward, even with extreme strength in the USD.”

“Staying with the trend, especially with the upcoming BRICS meeting,” said Mark Leibovit, publisher of the VR Metals/Resource Letter.

Sean Lusk, co-director of commercial hedging at Walsh Trading, was looking at the market setting fresh all-time highs on Friday, and wondered aloud what could possibly stop gold’s momentum.

“You get a breakdown in energies this week, it doesn't matter,” he said. “You’ve got the recent uptick in the dollar, that hasn't mattered, has it? I mean, nothing. Equities, doesn't matter, whatever the bond market does or doesn't do, it doesn't matter either.”

“Your traditional safe havens are higher bond yields, which would cause metals to suffer,” he added. “Higher dollar causes metals to suffer, and it does not matter. It just tells you this thing is so strong. Everyone's got it pegged technically till about $2,770, $2,780 and then we'll see where we go.”

“It's just unrelenting,” he marveled. “And these recent dips, even the corrections are $50, $60 in size, shape, and scope. Hardly anything. That's why I keep saying the integrity of the market is really in question here, because good, bad, or indifferent, we continue to churn higher and outside of something else entering the market, providing some uncertainties where everyone goes home and takes profit, that's all we're really getting.”

“Nothing goes up forever, right? Or down forever,” Lusk said. “But in this case, it just keeps going up forever. This market's due for a sizable chop here, but we'll see. We might be up another $40, $50 higher before that happens.”

This week, 16 analysts participated in the Kitco News Gold Survey, and weeks of Wall Street pessimism have given way to a near-total bullish consensus. 15 out of 16 experts, 94% of those surveyed, believe gold prices will rise even higher during the week ahead, while the lone remaining analyst, representing 6%, was neutral on gold’s near-term prospects. None thought it wise to predict a price decline for the precious metal.

Meanwhile, 159 votes were cast in Kitco’s online poll, with a strong majority of Main Street investors rejoining the bull run. 115 retail traders, or 72%, looked for gold prices to rise next week, while only 27, or 17%, expected the yellow metal to trade lower. The remaining 17, representing 11% of the total, though prices would trend sideways during the week ahead.

| TIME | |||||

|---|---|---|---|---|---|

| Sydney | Tokyo | Ha Noi | HongKong | LonDon | NewYork |

| Prices By NTGOLD | ||

|---|---|---|

| We Sell | We Buy | |

| 37.5g ABC Luong Bar | ||

| 9,553.30 | 8,568.30 | |

| 1oz ABC Bullion Cast Bar | ||

| 7,971.00 | 7,106.00 | |

| 100g ABC Bullion Bar | ||

| 25,391.90 | 22,521.90 | |

| 1kg ABC Bullion Silver | ||

| 4,954.90 | 3,564.90 | |

Powered by: Ngoc Thanh NTGold

- Online: 59

- Today: 2079

- Total: 7157943